Startup

Limited Liability Partnership

Limited Liability Partnership (LLP) has become a popular legal structure for businesses

0

+

Business Served

in 5+ years

0

rated on Google

by our customers

0

hr

24x7 Support

Available Always

Get Started Today!

Limited Liability Partnership (LLP) has become a popular legal structure for businesses. Its main improvement over the General Partnership is that, as the name indicates, it limits the liabilities of its partners to their contributions to the business and also offers each partner protection from the negligence, misdeeds or incompetence of the other partners. Limited Liability partnership provides advantage of limited liability to its owners and at the same time requires minimal maintenance.

Limited Liability Partnership (LLP) in India took shape after January 2009, making it an instant success with startups and professional services. Limited Liability Partnership Registration, governed by the Limited Liability Partnership Act, 2008, combines the benefits of a partnership with that of a limited liability company. LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability.

Why Limited Liability Partnership – Benefits

Separate Legal Entity

A LLP is a legal entity and a juristic person established under the Act. Therefore, a LLP has wide legal capacity and can own property and also incur debts. However, the Partners of a LLP have no liability to the creditors of a LLP for the debts of the LLP.

Uninterrupted Existence

A LLP has ‘perpetual succession’, that is continued or uninterrupted existence until it is legally dissolved. A LLP being a separate legal person, is unaffected by the death or other departure of any Partner. Hence, a LLP continues to be in existence irrespective of the changes in ownership.

Audit NOT Required

A LLP does not require audit if it has less than Rs. 40 lakhs of turnover and less than Rs.25 lakhs of capital contribution. Therefore, LLPs are ideal for startups and small businesses that are just starting their operations and want to have minimal regulatory compliance related formalities.

Owning Property

A LLP being an artificial judicial person, can acquire, own, enjoy and sell, property in its name. No Partner can make any claim upon the property of the LLP – so long as the LLP is a going concern.

Easy Transferability

Businesses often need to borrow money. In a General Partnership, partners are personally liable for all this debt. So if it cannot be repaid by the business, the partners would have to sell their personal possessions to do so. In an LLP, only the amount invested in starting the business would be lost; all personal property would be safe.

Limited Liability

The ownership of a LLP can be easily transferred to another person by inducting them as a Partner of the LLP. LLP is a separate legal entity separate from its Partners, so by changing the Partners, the ownership of the LLP can be changed.

Reduced Compliance

An LLP only requires audited annual returns to be filed if it has a turnover of greater than Rs. 40 lakh or capital contribution of over Rs. 25 lakh. It also needs to communicate fewer business transactions and structural changes than a private limited company.

Tax Advantages

There are some important advantages over the private limited company. For example, Dividend Distribution Tax and tax surcharge don’t apply. Loans to partners are also not taxable as income.

Looking for help?

Let our experts help you

drop us a mail at support@filingduniya.com & or call us at +91-44-42691489 | +91-9940043113

- Process

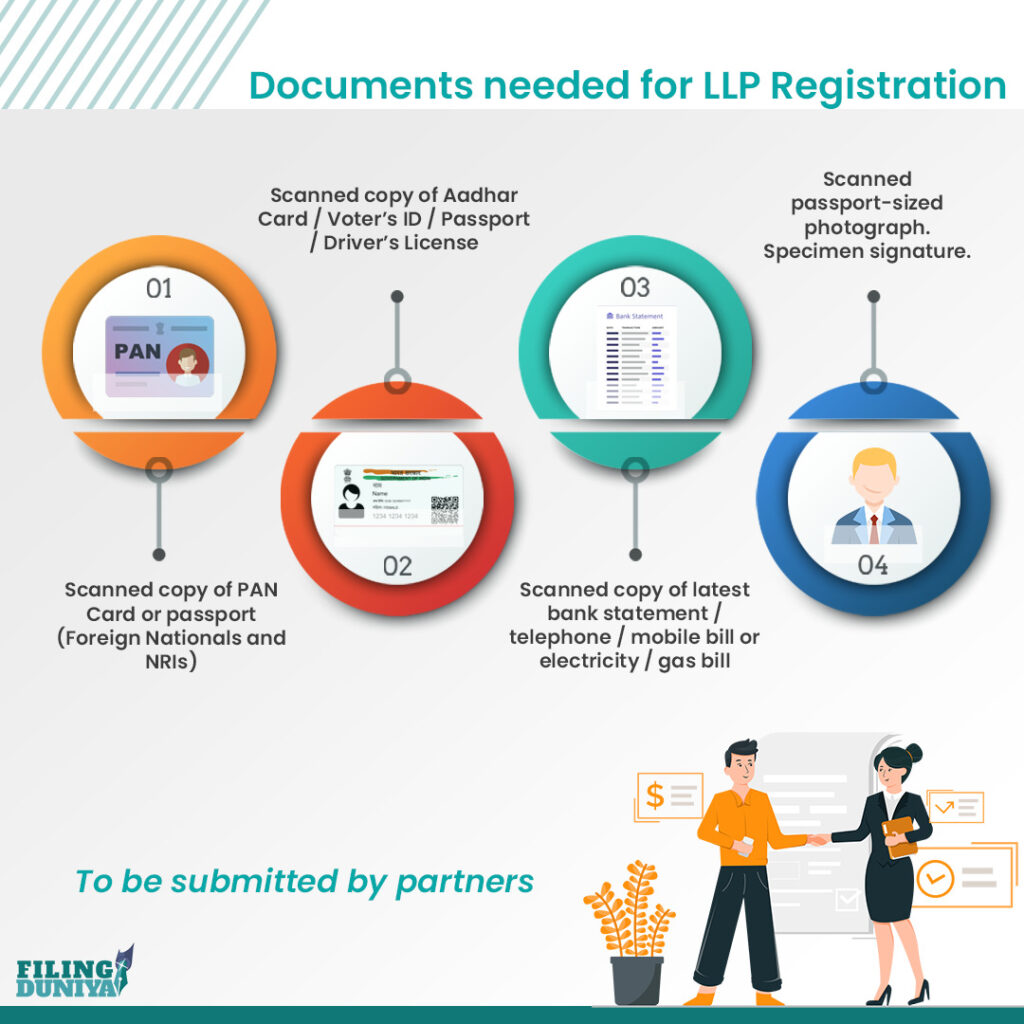

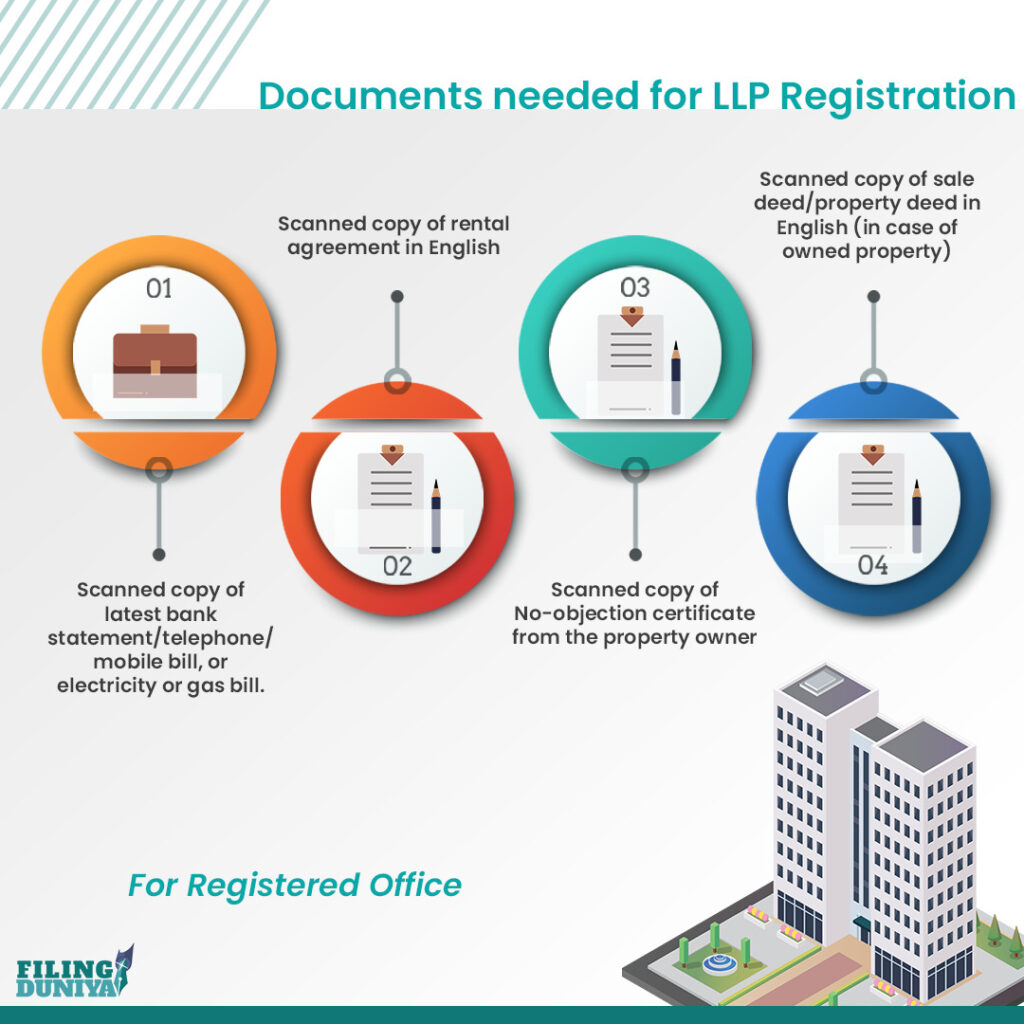

- Documents Required

- Eligibility Check

- Naming Factors

Quick and easy steps to register LLP in India - A detailed process

At Filing Duniya, we make the process of LLP registration seamless and hassle-free.

- Arrange basic documents of Partners

- Fill in an online form with accurate information

- Apply for Digital Signature and DIN of Partners

- Prepare all legal documents

- Apply to name availability of the proposed LLP

- Verification of all documents and forms by the respective Government dept and authorities

- File Incorporation Docs with ROC

- Get LLP Incorporation Certificate

- Drafting of LLP Agreement

- Filing of LLP Agreement

Step 1: Obtaining DSC And DIN

The first step is to obtain DSC of the desired partners of the Limited Liability Partnership. The reason for this is that all the forms need to be submitted online and require the directors' digital signatures.

The law also requires that all directors file for a DIN number. The application has to be made in Form DIR- 3.

Step 2: Application For Name Approval

This process involves registering the LLP. Before you do this, you would need to see if the name is already taken. You can check on the free search facility on the MCA portal. The registrar only approves LLP names that are not taken before.

The approval of the name will be made by the Registrar only if the Central Government does not deem it undesirable. The name should also not hold any resemblance to any of the existing partnership firms, LLPs, trademarks, or body corporates.

Step 3: LLP Agreement

LLP agreement is very crucial in a limited liability partnership as it determines the mutual rights and duties amongst the partners, and between the LLP and the partners. The partners enter into the LLP agreement upon the LLP registration by filing form 3 online on the MCA portal. This procedure has to be done within 30 days of the date of incorporation.

Step 4: LLP Incorporation Certificate

Once the registrar approves your MOA and AOA, you’re steps closer to getting your LLP registered. The next step is to get the LLP Incorporation Certificate. You can do by submitting all documents to the registrar. The time frame is between 2- 12 days. Once you get your LLP Incorporation Certificate, you’re ready to go.

Step 5: Apply For PAN & TAN & Bank Account

As soon as you get the incorporation certificate, you need to apply for your company PAN & TAN with the NSDL. The cost for this procedure is less than Rs.200 and it takes around three weeks to get done.

Check if your firm qualifies for LLP in India

Starting a business requires certain specific requirements to be fulfilled to be eligible for registering as an LLP.

The normal partnership structure and LLP share the same attributes when it comes to internal management, profit distribution and tax liabilities. But, it offers the partners less financial liability (limited liability).

Any business who has:

- At least two partners are required to form an LLP. There is no limit to the maximum number of partners

- The nomination of a natural person, if a body corporate is a Partner

- No shared capital requirement, though each partner must have an agreed contribution towards it.

- Minimum capital contribution: There is no minimum capital requirement for an LLP (or a company, for that matter). The LLP should have an authorized capital of at least Rs. 1 lakh.

- At least one Designated Partner as an Indian resident

- DPIN for all Partners

- DSC for all the Designated Partners

- Address proof for the office of LLP. The registered office of an LLP does not have to be a commercial space. Even a rented home can be the registered office, so long as an NoC is obtained from the landlord.

- With regard to the changes in the FDI regulations dated November 10, 2015, foreign investors are now permitted to have a 100% FDI in the automatic route LLP. The 100% FDI in the LLP is granted to foreign companies who operate in activities or sectors where 100% FDI is considered permissible through the channels of the automatic route. Also, there should not be any performance prerequisites that are linked to FDI. A definite interpretation of the terms such as ‘ internal accruals’ and ‘ownership and control’ has been provided with reference to the LLP. Thus, Foreign investment is made smoother and quicker with FDI in LLP.

- The LLPs will also be permitted to opt for downstream investment in a different company or even choose LLP in those sectors which allow 100% FDI in accordance with the automatic route. This does not come up with any performance constraints that are FDI linked.

At Filing Duniya, we make the process of LLP registration seamless and hassle-free.

The Registrar of Companies (RoC) has issued naming guidelines for LLPs. It is essential that you follow the rules closely or your application may end up getting rejected, leading to a much longer process.

Unique Component:

In AlphaBeta Internet Private Limited, AlphaBeta is the unique component. Now, once taken, the name will not be given to any other business in categories related to the Internet.

Blacklist:

Abbreviations, adjectives and generic words are rejected. So XYZ would be rejected, as would Good Quality Biscuits. The words bank, exchange and stock exchange, unless approved by RBI or SEBI, would also be rejected.

No Common Trademark:

There should not be a registered trademark by the same name on the IP India website. If there is one, the name can only be approved if you are able to get a No-Objection Certificate from its owner authorising you to use it.

Descriptive Component:

In Biocon Research Private Limited, the word 'Research' describes the business the company is into. You cannot have 'Research' in your name if you're, say, in the logistics or restaurant business.

Check LLP Name Availability

Naming an LLP is often a time-consuming process as the government has put together a complicated procedure with several rules. Furthermore, there are acceptable names for an India LLP, as per the Companies Act, 2013 and LLP Act, 2008.

Confused? Give us a call. Our experts are available for help!

Process

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

Pick Your Plan | Pay Online | Get 100% Assistance

Limited Liability Partnership

Bestseller

True

Limited Liability Partnership

₹ 7499

LLP registration with DSC, DIN, LLP deed drafting, name approval, PAN, TAN and government fees for incorporation. Inclusive of government fee.

Enterprise

Super

Limited Liability Partnership

₹ 16499

LLP registration with DSC, DIN, LLP deed drafting, name approval, PAN, TAN, government fees for incorporation and (one year TDS return filing/Trademark registration). Inclusive of government fee.

On receipt of the documents we at Filing Duniya can get the trademark registration process commence in less than a day’s time. As our availability has never been an issue you can feel free to contact us over text messages, emails or call in case of any queries.

Frequently Asked Questions

- What is the eligibility of designated partners/partners in an LLP?

-

Any individual, or even a company or an LLP, can become a partner. However, only an individual can become a ‘designated partner’ in an LLP.

- I am an NRI. Can I start an LLP business in India?

-

Yes, non-resident Indians and foreign nationals who are willing to enter into an LLP partnership can do so, provided they submit the necessary documents after getting it notarized by the concerned authorities. Although, at least one of the designated partners in an LLP should be an Indian national.

- What are the rules of starting an LLP?

-

Any group of persons who have or want to invest money in a business can start an LLP. A person or an investor becomes a partner, according to the LLP agreement, as provided in the Act of 2008. Also, the investors/partners are owners of the business started under the LLP.

- How can I run a trademark search?

-

Before settling on a brand name, you need to check if it can acquire the legal rights necessary to hold on it. This is because the commercial rights to a brand name belong to the owner of its trademark. To find out if yours has already been taken, you can run a trademark search, which is basically a database search of India’s Intellectual Property Database. Now, running the search is easy. Begin by selecting the wordmark and typing in the word/s you want to register. The results will tell you whether there already is another registration in that name.

If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either. - What is an LLP agreement?

-

An LLP agreement is one that is made between the partners and the LLP regarding the relationship between the individual partners in the LLP. An LLP agreement usually consists of management policies, inclusion of new partners, policy making strategies, and so on. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- What is the minimum number of partners required to start LLP?

-

According to the LLP Act, a minimum of two designated partners are required to start an LLP. The designated partners are responsible for fulfilling all the essential requirements involved in starting and running an LLP. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- What kind of start-ups commonly register LLPs?

-

Typically, only start-ups that will not be looking for venture capital funding register LLPs. This is because venture capitalists only invest in private and public limited companies.

- Is it cheaper to run an LLP than a private limited company?

-

Yes, it is much cheaper to run an LLP than a private limited company, particularly in your early start-up days. This is because many compliances, such as an audit, apply to LLPs only after their turnover is sizeable. Most LLPs spend about half as much as a private limited company in their first year on registrations and compliance work.

Pick Your Plan | Pay Online | Get 100% Assistance

Your Company Might Also Require

Producer Company

Startup Producer Company A Producer Company was introduced in India with the…

Read MoreNidhi Company

Startup Nidhi Company Nidhi Company registration including Incorporation kit and share certificates.…

Read More