Startups

Partnership

A Partnership is a business structure in which two or more individuals manage and operate a business in accordance with the terms and goals set out in the Partnership Deed.

0

+

Business Served

in 5+ years

0

rated on Google

by our customers

0

hr

24x7 Support

Available Always

Get Started Today!

A Partnership is a business structure in which two or more individuals manage and operate a business in accordance with the terms and goals set out in the Partnership Deed. Partnership registration is relatively easy and is prevalent among small and medium sized businesses in the unorganized sectors. Partnership Registration is done through Filing Duniya.

For Partnership Registration, you must agree on a firm name and then establish a partnership deed. It is a document stating respective rights and obligations of the partners and to be valid it should be written and not oral. The terms of the Partnership Deed can be varied to suit the interests of the partners and can even be made contrary to the Indian Partnership Act, 1932 but if the Partnership Deed is silent on any point, then the provisions of the Act would apply.

Choose Partnership because

- Partnership registration is very easy.

- Partnership registration is inexpensive as compared to LLP.

- It has minimum compliance requirement.

What are the benefits of Partnership?

What is a partnership firm?

A partnership firm is a business structure in which two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed that may or may not be registered. In such a business, the members are individually partners and share the liabilities as well as profits of the firm in a predetermined ratio.

Why should I set up a partnership firm?

A partnership firm is best for small businesses that plan to remain small. Low costs, ease of setting up and minimal compliance requirements make it a sensible option for such businesses. Registration is optional for General Partnerships. It is governed by Section 4 of the Partnership Act, 1932. For larger businesses, it has lost its relevance with the introduction of the Limited Liability Partnership (LLP).. This is because an LLP retains the low costs of a partnership while providing the benefit of unlimited liability, which means that partners are not personally liable for the debts of the business.

Is a partnership firm a separate entity?

The partners in a partnership firm are the owners, and thus, are not a separate entity from the firm. Any legal issues or debt incurred by the firm is the responsibility of its owners, the partners.

How many partners can there be?

A partnership must have at least two partners. A partnership firm in the banking business can have up to 10 partners, while those engaged in any other business can have 20 partners. These partners can divide profits and losses equally or unequally.

Is partnership firm registration necessary?

No, partnership registration is not necessary. However, it is advisable for you to have a partnership firm registration online. Also, remember that for a partner to sue another partner or the firm itself, the partnership should be registered. Moreover, for the partnership to bring any suit to court, the firm should be registered. For this reason, it is recommended that larger businesses register the partnership deed.

What are the main aspects of a partnership deed?

The deed should contain names of the partners and their addresses, the partnership name, the date of commencement of operation of the firm, any capital invested by each partner, the type of partnership and profit-sharing matrix, rules and regulations to be followed for intake of partners or removal.

Looking for help?

Let our experts help you

drop us a mail at support@filingduniya.com & or call us at +91-44-42691489 | +91-9940043113

- Benefits

- Documents Required

- Process Duration

Benefits of a Partnership

Minimum Compliance

For General Partnerships, there is no need for an auditor to be appointed or, if the company is still in the process of registration or incase unregistered, annual accounts filing with the registrar is not necessary either. When compared to LLP, annual compliances are also fewer. Further, taxes depending on turnover, service and sales tax also need not be filed in General Partnerships.

Simple To Begin

General Partnerships can begin simply with an unregistered deed of the partnership within 2-4 business days. However, having registration for the same has its own perks and advantages. The primary advantage for having a registered firm is that it will allow you to book lawsuits in courtrooms opposing another business or the business associates in the firm for the administration of rights addressed in the Partnership Act.

Comparatively Economical

In comparison to LLP, a General Partnership is much cheaper to begin. Even in the longer run, it will still work out inexpensive as the compliance requirements are very minimal. For example, there is no need for an auditor. Therefore, Home businesses still opt for this, although it offers unlimited liability.

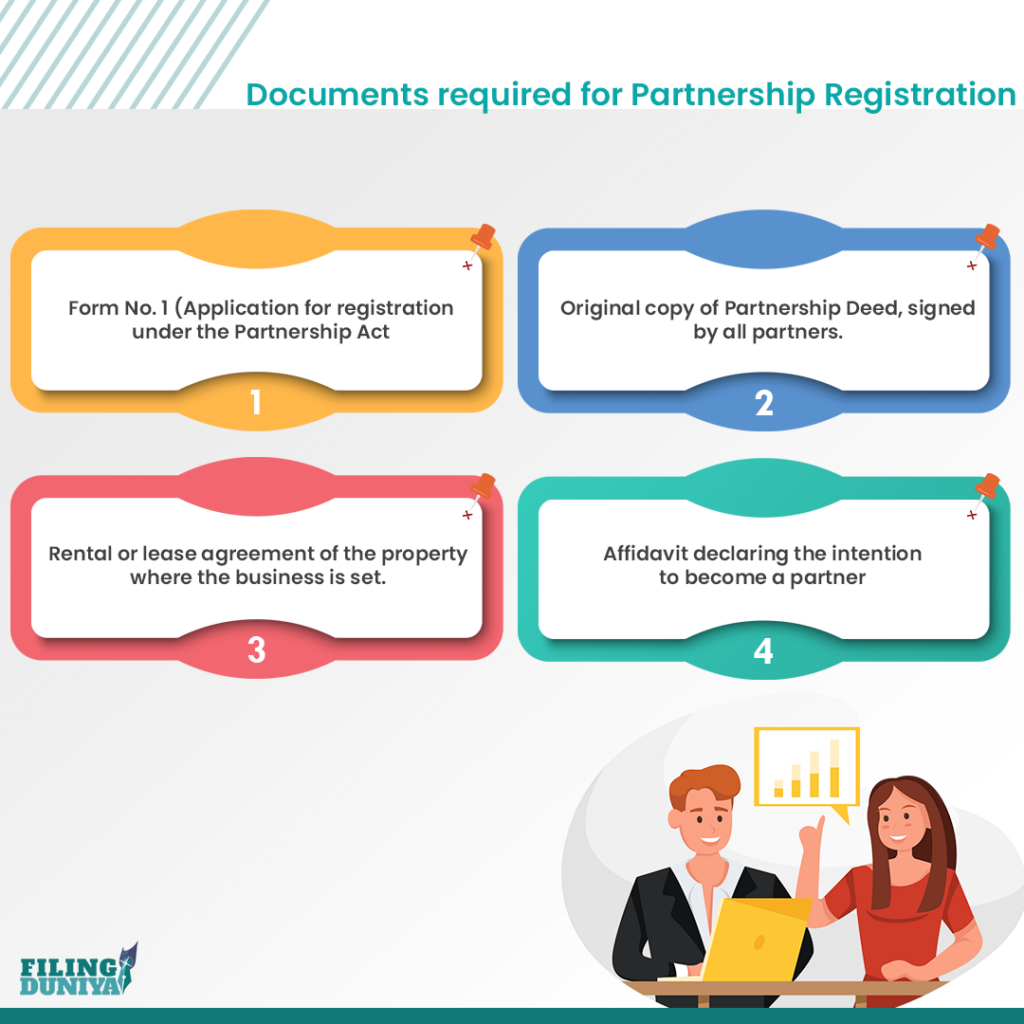

Documents needed for Trademark Registration

- Form No. 1 (Application for registration under Partnership Act)

- Original copy of Partnership Deed, signed by all partners

- Affidavit declaring intention to become partner

- Rental or lease agreement of the property/campus on which the business is set.

Common Partnership Policies

4 BUSINESS DAYS

Once we receive your request, our representatives will contact you to better grasp your specifications. Additionally, If other information is needed, we will reach out to you once again. Our lawyers and legal experts will carry out your requests. Once they are done, it will be sent for your viewing and verification within 4-5 business days. However, you can always contact us if there are changes needed.

4 BUSINESS DAYS

If there are any changes required to the agreement, our experts will have them altered. As agreed upon iteration changes twice is covered in the original cost.

Confused? Give us a call. Our experts are available for help!

Process

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

Pick Your Plan | Pay Online | Get 100% Assistance

Partnership

Bestseller

On receipt of the documents we at Filing Duniya can get the trademark registration process commence in less than a day’s time. As our availability has never been an issue you can feel free to contact us over text messages, emails or call in case of any queries.

Frequently Asked Questions

- How many people are required to start a Partnership firm?

-

A minimum of two Persons is required to start a Partnership firm. A maximum number of 20 Partners are allowed in a Partnership firm.

- What are the requirements to be a Partner in a Partnership Firm?

-

The Partner must be an Indian citizen and a Resident of India. Non-Resident Indians and Persons of Indian Origin can only invest in a Proprietorship with prior approval of the Government of India.

- What are the documents required to start a Partnership Firm?

-

PAN Card for the Partners along with identity and address proof is required. It is recommended to draft a Partnership deed and have it signed by all the Partners in the firm.

- How will Filing Duniya help me start a Partnership Firm?

-

A Filing Duniya Associate will understand your business requirements and help you start a Partnership firm by drafting the Partnership deed. Based on the requirements, Filing Duniya can also help register the Partnership deed with the relevant Authorities to make the Partnership Firm a Registered Partnership firm. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- What are the advantages of a Registered Partnership firm?

-

Only a registered Partnership firm can file a suit in any court against the firm or other partners for the enforcement of any right arising from a contract or right conferred by the Partnership Act. Also, only a Registered Partnership firm can claim a set off (i.e. mutual adjustment of debts owned by the disputant parties to one another) or other proceedings in a dispute with a third party. Hence, it is advisable for Partnership firms to get itself registered sooner or later. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- How to open a bank account for a Partnership firm?

-

To open a bank account for a Partnership firm, a registered Partnership deed along with identity and address proof of the Partners need to be provided. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- Will my Partnership firm have a separate legal identity?

-

No, a Partnership firm has no separate legal existence of its own i.e., the Partnership firm and the partners are one and the same in the eyes of law. Liability of the Partners is also unlimited, and the partners are said to be jointly and severally liable for the liabilities of the firm. This means that if the assets and property of the firm is insufficient to meet the debts of the firm, the creditors can recover their loans from the personal property of the individual partners.

- Will my Partnership firm have a Certificate or Registration?

-

If the Partnership firm is registered, the Partnership deed will be registered and a Registration Certificate will be issued by the Registrar of Firms.

- How to register the name of a Partnership firm?

-

Partnership firms are business entity that are owned, managed and controlled by one person. So Partners cannot be inducted into a Partnership firm. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

- How can I transfer my Partnership firm?

-

There are restrictions on the transfer of ownership interest in a Partnership firm. A Partner cannot transfer his/her interest in the firm to any person (except to the existing partners) without the unanimous consent of all other partners. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

- Can other people invest in a Partnership firm?

-

Indian Nationals and Indian Residents are allowed to invest in a Partnership firm without any approval. Usually those who invest in the Partnership firm become a Partner of the firm and in the absence of any agreement to the contrary, all partners will have a right to participate in the activities of the business. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

- What are the annual compliance requirements for a Partnership?

-

Partnership firm will have to file their annual tax return with the Income Tax Department. Other tax filings like service tax filing or VAT/CST filing may be necessary from time to time, based on the business activity performed. However, annual report or accounts need not be filed with the Ministry or Corporate Affairs, which is required for Limited Liability Partnerships and Companies. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

- Is audit required for a Partnership firm?

-

It is not necessary for Partnerships to prepare audited financial statements each year. However, a tax audit may be necessary based on turnover and other criterion. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

- Can I later convert my Partnership firm into a Company or LLP?

-

Yes, there are procedures for converting a Partnership business into a Company or a LLP at a later date. However, the procedures to convert a Partnership firm into a Company or LLP are cumbersome, expensive and time-consuming. Therefore, it is wise for many entrepreneurs to consider and start a LLP or Company instead of a Partnership firm. A patent is a right granted for a product or process to an individual or enterprise. This right grants its owner the ability to exclude others from making, using, selling or importing the patented product or process without prior approval. In exchange for this right, the applicant must fully disclose the invention. A patent is valid for 20 years, after which it falls into the public domain.

Pick Your Plan | Pay Online | Get 100% Assistance

Your Company Might Also Require

Producer Company

Startup Producer Company A Producer Company was introduced in India with the…

Read MoreNidhi Company

Startup Nidhi Company Nidhi Company registration including Incorporation kit and share certificates.…

Read More