Startups

One Person Company Registration

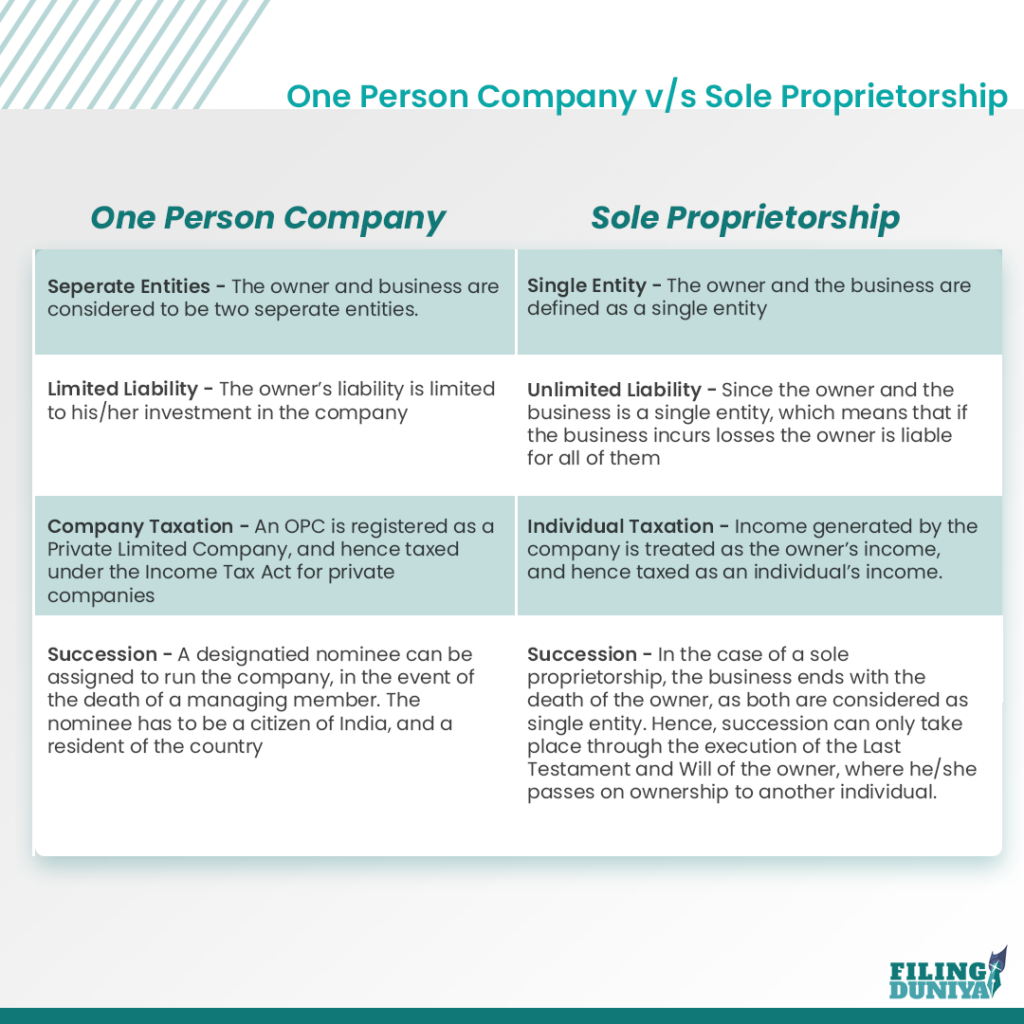

The One Person Company (OPC) was as of late presented as a solid change over the sole proprietorship

0

+

Business Served

in 5+ years

0

rated on Google

by our customers

0

hr

24x7 Support

Available Always

Get Started Today!

The One Person Company (OPC) was as of late presented as a solid change over the sole proprietorship .The possibility of One Person Company (OPC) in India was acquainted with give a lift to business visionaries who can possibly begin their own wander by enabling them to make a solitary individual organization.

So, if you want to start up your own business, you don’t have to worry about all the complex and tedious processes. , if an OPC hits an average three-year turnover of over Rs. 2 crore or has a paid-up capital of over Rs. 50 lakh, it must be turned into a private limited company or public limited company within six months. One Person Companies are helping tremendously in increasing the overall economy of India. More and more Entrepreneurs are coming up and setting up their business. Since, no intervention from any third party is seen, it makes it more beneficial.

Features of One Person Company

- Only one member is required.

- Easy to set up and maintain comparatively.

- Limits the liabilities of its members.

- Minimal Paperwork is required.

- Can act as Stockbroker or Sub-broker.

- Not much compliance.

Benefits of One Person Company

Limited Liability

The directors’ personal property is always safe in a private limited company, no matter the debts of the business.

Continuous Existence

Sole Proprietorships come to an end with the death of the proprietor. As an OPC has a separate legal identity, it would pass on to the nominee director and, therefore, continue to exist.

Greater Credibility

As an OPC needs to have its books audited annually, it has greater credibility among vendors and lending institutions.

Single Promoter

One Person Company is the only type of corporate entity that can be started and operated by a single promoter with limited liability protection in India. A corporate form of legal entity in One Person Company ensures that the business has perpertual existence and easy ownership transferability.

Uninterrupted Existence

A company has ‘perpetual succession’, meaning uninterrupted existence until it is legally dissolved. A company being a separate legal person, is unaffected by the death or other departure of any member and continues to be in existence irrespective of the changes in ownership.

Borrowing Capacity

Banks and Financial Institutions prefer to provide funding to a company rather than partnership firms or proprietary concerns. However, a one person company cannot issue different types of equity security, as it can only be owned by one person at all times.

Easy Transferability

Ownership of a business can be easily transferred in a company by transferring shares. The signing, filing and transfer of share transfer form and share certificates is sufficient to transfer ownership of a company. In a one person company, the ownership can be transferred by altering the shareholding, directorship and nominee director information.

Owning Property

A company being an artificial person, can acquire, own, enjoy and alienate, property in its name. The property owned by a company could be machinery, building, intangible assets, land, residential property, factory, etc., Further, the nominee director cannot claim any ownership of the company while serving as a nominee director.

Looking for help?

Let our experts help you

drop us a mail at support@filingduniya.com & or call us at +91-44-42691489 | +91-9940043113

- Documents Required

- Package Inclusion

- Process Duration

- Nominee

Documents required for OPC Registration

The director of the OPC should submit the scanned transcripts/ copies of the following documents mandatory for OPC registration-

- PAN card or Passport

- Passport, for NRIs and Foreign Nationals

- Scanned transcript of Driver's License or Voter’s ID

- Updated gas or electricity invoice/Bank account Statement/Mobile or landline phone invoice

- Specimen signature or impression

- Passport-sized photo

Please Note: The first 3 documents should be self-attested by the OPC director. All the documents for a foreign national or an NRI must be notarized (if residing in India or a non-Commonwealth country at present) or apostilled (if living in a Commonwealth country at present).

Documents Necessary For The Registered Office

- Scanned transcript of Current Bank Account Statement/Phone or Mobile Invoice/Gas or Electricity Invoice)

- Scanned transcript of Rental Agreement written in the English language

- Scanned transcript of N-O or No-objection Certificate from the concerned property landowner

- Scanned transcript of Property or Sale Deed printed in English (if the property is owned)

Note: Your office space which is registered needs to be a commercial area; however, it can be your house of residence as well

Quick and easy steps to register LLP in India - A detailed process

- Directors Identification Number for 1 Director

- Digital Signature Certificate for 1 Director (If the shareholders are different from directors, then additional DSC is required for Shareholders)

- Guidance for choosing the Company Name

- PAN Number

- TAN Number

- The registration process includes - Drafting the Memorandum & Articles of Association, RoC filing fees for an authorized capital, Government Stamp Duty, and Certificate of Incorporation.

- Name Approval Certificate

- GST Registration

- PF Registration

- ESI Registration

- PT Registration (Only applicable in Maharashtra)

OPC Registration Process Duration

5 Business Days

Firstly, the OPC director should petition or apply for the DSC otherwise known as Digital Signature Certificate, which is mandatory to file for the company registration records. For this to come through, one only needs to submit a few scanned documents; after which our agents will file the form by filling it and put it online for submission.

7 Business Days

Once the application for the DSC is done, our agents will ask you to choose a name for your business and send us the relevant scanned documents for the same. The sent documents will be used to file for the SPICe i.e. INC-32 and the MoA is otherwise known as the Memorandum of Association and the AoA also known as the Articles of Association. Finally, at the end of this process, the Certificate of Incorporation will be processed and approved.

2 Business Days

All companies need a registered PAN or Permanent Account Number and TAN or Tax Account Number. The application will be filed online by our representatives, however, you will be asked to courier the hard copies of the relevant and required documents yourself. Post the processing, the TAN and PAN will be dispatched to you to your registered office address only within 21 business days.

Nominee in One Person Company

The rules for incorporation of one person company requires that the sole member of a One Person Company should include the name of a nominee in the Companies MOA, who will undertake the entity after the expiry or incapacity of the former. Moreover, the document must contain the written consent of the nominee, which must also be filed with the Registrar during incorporation along with the MOA and AOA.

Withdrawal of Consent

The nominee is entitled to withdraw his/her consent, in which case the sole member is required to nominate another member as a legal heir within 15 days of the notice of withdrawal. The nomination of new personnel must be intimated to the Company through a written consent in Form INC-3. The Company, in turn, is required to file the notice of withdrawal of consent along with the intimation of the new nominee with the Registrar in Form INC 4.

Change of Nominee

The sole member of a 'One Person Company' is empowered to change the nominee of the Company for any reason whatsoever, by providing notice in writing to the Company. Again, the new nominee must consent to the nomination in Form INC 3, and the Company must file the notice of change and consent of the nominee with the Registrar along with the applicable fee, within 30 days of receiving the intimation of change.

Nominee Appointment

If a nominee becomes in-charge of the one person company due to the cessation of the original member's term owing to the death or incapacity of the latter, the new member must appoint a nominee as a replacement.

Penalty

If a One Person Company or an officer of such Company is not compliant with the specified regulations, the entity or the officer will incur penalties which could be as high as Rs 10,000. Further, the penalty will be increased by a fine of Rs 1,000 for each day of default.

Confused? Give us a call. Our experts are available for help!

Process

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

01

Trademark Search

We conduct a thorough search of the TM directory

Pick Your Plan | Pay Online | Get 100% Assistance

One Person Company

Bestseller

Basic

One Person Company

₹ 7899

One person company registration with DIN, incorporation fee, PAN, TAN, share certificates and company kit. Inclusive of government fee and GST.

Bestseller

True

One Person Company

₹ 9899

One person company registration with DSC, DIN, name approval, incorporation fee, PAN, TAN, share certificates, (one year TDS filing/Trademark registration). Inclusive of government fee.

Bestseller

Super

One Person Company

₹ 14899

One person company registration with DSC, DIN, name approval, incorporation fee, PAN, TAN, share certificates, with 10 Lakh of authorised capital (one year TDS filing/Trademark registration). Inclusive of government fee and GST.

On receipt of the documents we at Filing Duniya can get the trademark registration process commence in less than a day’s time. As our availability has never been an issue you can feel free to contact us over text messages, emails or call in case of any queries.

Frequently Asked Questions

- Why should I form an OPC?

-

An OPC is a good alternative to running a sole proprietorship, largely because it gives limited liability to the business owner. This means that your liability is limited to the amount you’ve invested in the business; business debts cannot be recovered from personal possessions. Also, a sole proprietorship ceases to exist on the death of its promoter. In the case of an OPC, the nominee director takes over and the entity continues to exist. Single entrepreneurs who do not have another partner to start a private limited company may also consider it.

- Who can register for an OPC?

-

OPC company registration can be done only by Indian residents, and that, too, only one at a time, as per the specifications of the Ministry of Corporate Affairs.

- What are the mandatory requirements of an OPC?

-

How much capital is required to start an OPC?

- What are the tax advantages available to an OPC?

-

No general advantages; though some industry-specific advantages are available. Tax is to be paid at flat rate of 30% on profits, Dividend Distribution Tax applies, as does Minimum Alternate Tax. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- What is the main drawback of an OPC?

-

The MCA is skeptical about a single person in charge of a large corporation. Therefore, it requires all OPCs to be converted into private limited or public limited companies on crossing a certain revenue number. Currently, in case of an average turnover of Rs. 2 crore or more for the three consecutive years or a paid-up capital of over Rs. 50 lakh, the OPC must mandatorily be converted into an OPC. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- How much does it cost to run an OPC?

-

The cost of an OPC is only marginally lower than that of a private limited company. You’ll be shelling out around Rs. 12,000 to incorporate, then paying around Rs. 15,000 a year in compliance fees and an auditor to inspect your books. If there is one, check its status. If it is either approved, applied, objected or opposed, it makes sense to pick another name. Do also check for phonetic similarities with other registered names. To do this, you need to select the dropdown at the top of the page. While the phonetic search isn’t very accurate, you can say with certainty that your trademark will be approved if there aren’t any relevant matches here either.

- How many directors can there by in an OPC?

-

An OPC has certain limitations. The person starting the business is its only director and shareholder. There is also a nominee director, but this person has no power whatsoever for raising equity funds or offer employee stock options. The nominee exists only to take over in case of the death or incapacitation of the director. The nominee is chosen by the director, and can be anyone, such as your spouse, parents or siblings. The nominee will need to provide identity proof during registration.

- Can I start more than one OPC at a time?

-

No, an individual can form only one OPC at a time. This rule applies to the nominee in an OPC, too.

Pick Your Plan | Pay Online | Get 100% Assistance

Your Company Might Also Require

Producer Company

Startup Producer Company A Producer Company was introduced in India with the…

Read MoreNidhi Company

Startup Nidhi Company Nidhi Company registration including Incorporation kit and share certificates.…

Read More